Blog > Understanding Florida’s Foreclosure Landscape: Insights from Thomas J. Morillo

Understanding Florida’s Foreclosure Landscape: Insights from Thomas J. Morillo

by

As we step into 2025, Florida's foreclosure market continues to shift. As a seasoned realtor and team lead of the TJM Home Team, I’ve been closely monitoring the trends and how they impact homeowners, buyers, and investors alike. Here’s a comprehensive look at what’s happening in the Sunshine State’s real estate market, backed by the latest data.

Florida’s Foreclosure Rankings

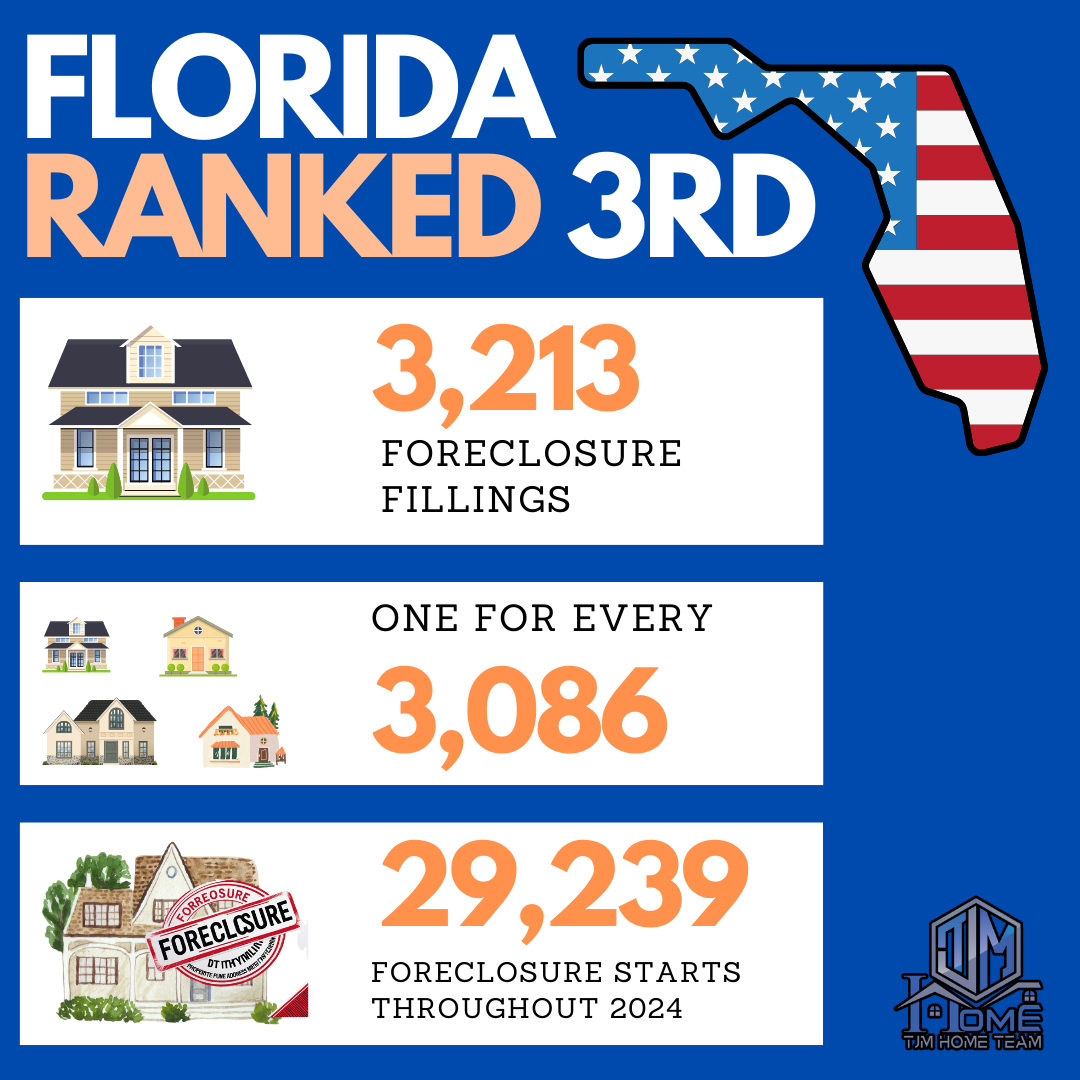

In October 2024, Florida ranked third in the nation for foreclosure rates, with a total of 3,213 foreclosure filings—one filing for every 3,086 housing units. The state also saw 29,239 foreclosure starts throughout 2024, trailing only behind California in sheer volume. These numbers reflect ongoing financial challenges for some homeowners, despite an overall robust real estate market.

Why Are Foreclosures Rising in Florida?

Several factors are contributing to this trend:

1️ Insurance Costs: Florida’s soaring property insurance premiums have become a significant burden on many homeowners, making it difficult for some to keep up with mortgage payments.

2️ Rising Property Taxes: With increased property valuations, property taxes have risen, adding more pressure.

3️ Economic Pressures: Inflation and cost-of-living increases have strained household budgets across the board.

Opportunities for Buyers and Investors

For buyers and investors, this market presents opportunities—but also challenges. Foreclosed properties often come at reduced prices, which can be appealing. However, purchasing a foreclosed home requires extra due diligence:

- Ensure a comprehensive inspection to avoid hidden repair costs.

- Work with experienced real estate professionals to navigate the process.

For Homeowners: What to Do If You’re Struggling

If you’re a homeowner facing financial difficulties, proactively communicating with your lender is critical. Many lenders offer options like:

- Loan modifications

- Forbearance plans

- Short sales

Additionally, working with HUD-approved housing counselors can provide a path forward.

My Takeaway for Florida Real Estate

While foreclosures are a challenging aspect of the market, they also highlight the importance of strategic planning—whether you’re buying, selling, or managing your homeownership. As the team lead of the TJM Home Team, I’m here to help homeowners and buyers alike navigate this evolving landscape with confidence.

Thinking of Buying, Selling, or Investing? Let’s Talk!

Whether you’re exploring opportunities in the foreclosure market or need guidance to avoid foreclosure, my team and I are here to support you every step of the way.

📞 Call or Text: 727-600-0891

📧 Email: thomasjmorillo@tjmhometeam.com

🌐 Visit: tjmhometeam.com

Let’s turn challenges into opportunities together. Reach out today!